Consideration and Determination of the State Fiscal and Financial Discipline offense case.

Consideration and Determination of the State Fiscal and Financial Discipline offense case.

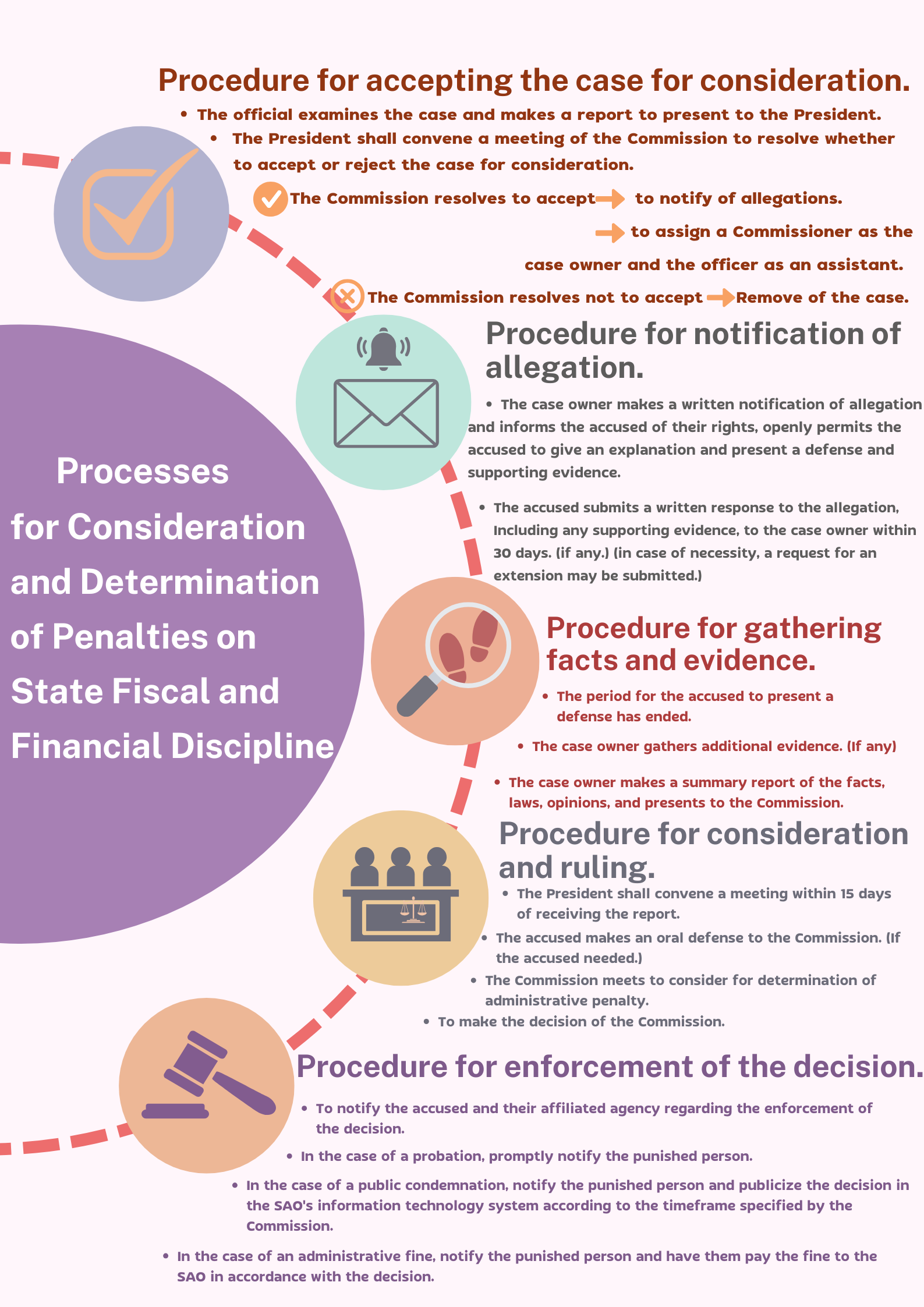

The State Audit Commission has issued the Regulations of the State Audit Commission on the Consideration and Determination of State Fiscal and Financial Discipline Offenses B.E. 2562 (2019), which prescribes the steps or processes for the consideration and Determination of state fiscal and Financial disciplinary offenses as follows:

1. Steps for Accepting or Not Accepting a Case for Consideration when the Auditor General Submits a Case to the State Audit Commission for Imposing Administrative Penalties on Auditee or State Officials. The State Audit Office will register the case in the registry and assign officials to examine the case in accordance with the criteria set forth in Sections 21, 22, and 23. They will also prepare a case examination report proposing their opinion to the President of the State Audit Commission. The President of the State Audit Commission will then convene a meeting of the State Audit Commission to promptly consider whether to accept or not accept the case for consideration.

- In case where the State Audit Commission resolves not to accept the case for consideration, the State Audit Office shall remove that case from the registry.

- In cases where the State Audit Commission resolves to accept the case for consideration and notify the allegation, it shall assign one of the State Audit Commissioners as the case owner and assign at least one official from the State Audit Office as the assistant to the case owner. The case owner shall proceed to notify the accused of the allegation to provide an opportunity for the accused to clarify and refute the allegation, along with presenting their own evidence to prove, confirm, rebut, or counter the allegation, both in factual and legal aspects.

2. Steps for Notifying and Clarifying/Refuting Charges The notification of allegation must be in writing, using the form prescribed by the State Audit Commission. It must specify the facts and circumstances constituting grounds for administrative penalties, along with copies of relevant evidence to the extent that allows the accused to understand the allegation. The accused must also be informed of the following matters:

- Resolution on the assignment of the case owner and the assistant to the case owner (Section 26, paragraph three)

- Right to object to the President of the State Audit Commission, a State Audit Commissioner, the case owner, and the assistant to the case owner (Section 17)

- Right to bring a lawyer or advisor to attend one's statement-taking or oral clarification (Section 9, paragraph two)

- Right to inspect, be informed of, request a copy, or request a certified true copy of documents or evidence submitted to the Auditor General or the State Audit Commission or the case owner or obtained by the State Audit Commission or the case owner (Section 15, paragraph one)

- Right to clarify and make oral statements before the State Audit Commission (Section 39)

The accused must submit a written clarification refuting the allegation, along with evidence (if any) ,to the case owner within 30 days from the date of receiving or being deemed to have received the written notification of allegation, except in the following cases:

- In cases where there are reasons and necessities making it impossible to submit the written clarification refuting the charges within the specified period, the accused may file a request for an extension with the case owner before the deadline for clarifying and refuting the allegation. The case owner may then issue an order granting an extension for clarifying and refuting the allegation for no more than 15 days and must inform the accused of this order.

- If there's a request for an extension exceeding 15 days for the benefit of justice, the matter must be proposed to the President of the State Audit Commission for consideration by the State Audit Commission. The State Audit Commission may then issue an order to extend the period as necessary. However, such a request must be made before the expiry of the period for clarifying and refuting the allegation.

- If the matter occurred more than 5 years from the date of the offense, or

When the accused fails to submit a written clarification refuting the allegation by the deadline, it shall be deemed that the accused has acknowledged the allegation and does not wish to clarify, refute, or rebut them.

3. Steps for Gathering Facts and Evidence Once the accused has clarified and refuted the allegation, or when the deadline for clarifying and refuting the allegation has ended, and the case owner deems it necessary to gather additional facts and evidence to prove the facts, they shall proceed to request that the audited entity, the accused, the Auditor General or officials assigned by the Auditor General, witnesses, or expert witnesses, provide written clarifications, submit relevant documents or other evidence, give opinions, provide statements, or they may conduct an on-site inspection.

In gathering facts and evidence, if it appears that the Auditor General or the accused was not previously aware of such facts or evidence, the case owner shall summarize the facts or evidence and inform the Auditor General or the accused, to provide an opportunity to clarify or present evidence to confirm or rebut.

4. Steps for Receiving Evidence and Preparing the Report by the Case owner Once the case owner has notified the allegation, received the clarifications refuting the allegation, and completed gathering facts and evidence, they will prepare a report summarizing the facts, legal aspects, and their opinion to the State Audit Commission within 30 days for consideration and determination. The case owner has the discretion to consider any evidence received during the determination process, not limiting it to only that submitted by the Auditor General or the accused.

5. Steps for Considering and Determining Administrative Penalties Once the President of the State Audit Commission receives the report from the case owner along with the case file, they will convene a meeting of the State Audit Commission to consider and make a determination within 15 days from the date of receiving the report and case file. Before determining the administrative penalty, the State Audit Commission has the authority to gather additional facts or evidence for the benefit of justice. Furthermore, if any accused person wishes to make an oral statement before the State Audit Commission, the State Audit Commission must provide that accused person with an opportunity to do so as necessary for the benefit of justice.

At the meeting for consideration, the case owner will present a summary of the facts, the issues of the charges, legal aspects, and their opinion to the State Audit Commission. In considering state Fiscal and Financial disciplinary offenses and imposing administrative penalties, the State Audit Commission will primarily use the audit report of the Auditor General and consider facts from the case file, the report of the case owner, as well as relevant laws.

- If the State Audit Commission considers that the facts and evidence are not sufficiently weighty to establish that an offense has been committed as alleged, it shall issue a decision to close the case.

- If the State Audit Commission considers that an offense has been committed as alleged, it shall issue a decision to impose an administrative penalty on the accused who committed the offense.

Once the State Audit Commission has prepared its decision , the State Audit Office will send a written notification of the decision to the accused and their affiliated agency, or their superior or supervisor, for acknowledgment or for enforcement in accordance with the decision, as the case may be.

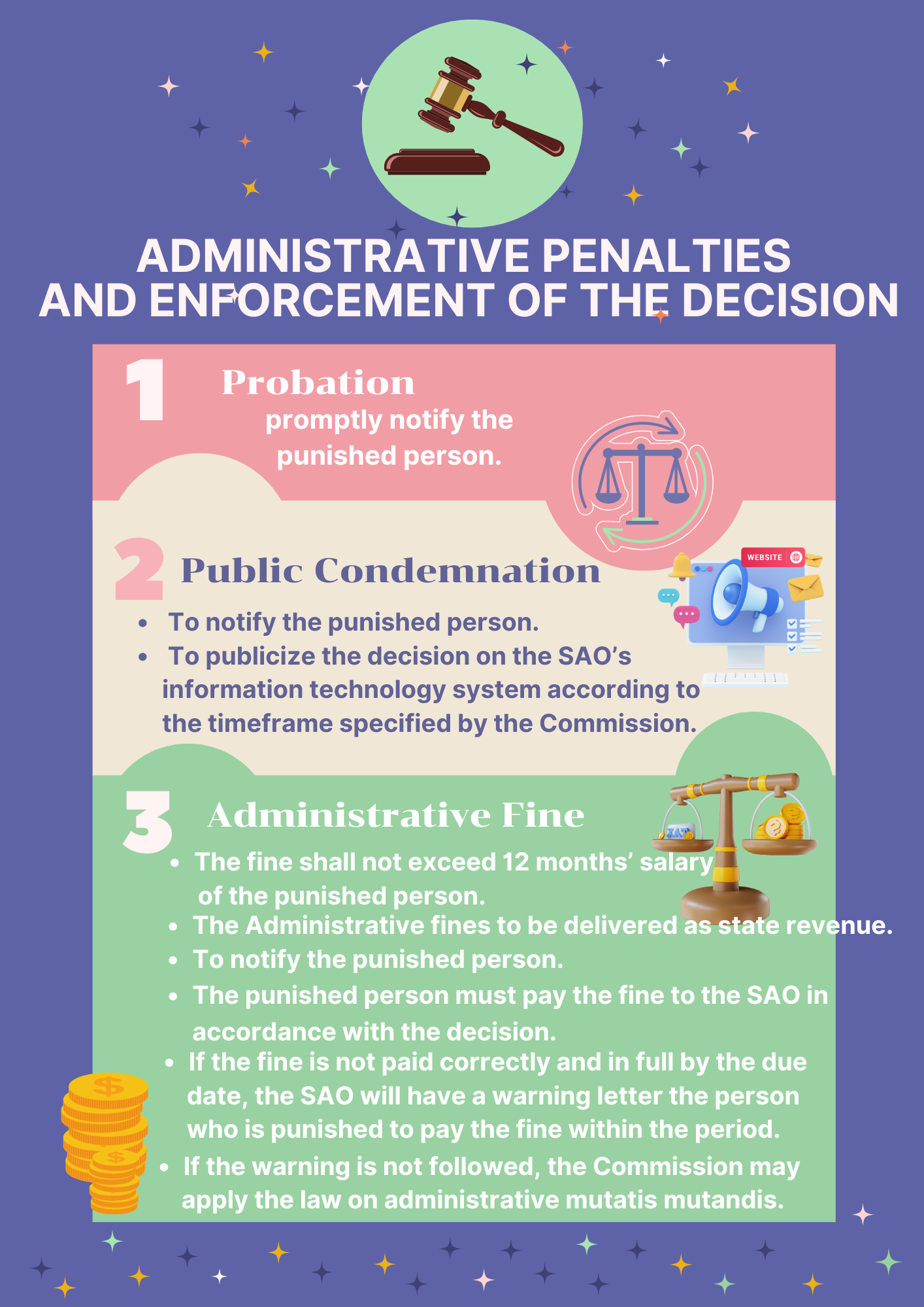

ADMINISTRATIVE PENALTIES AND ENFORCEMENT OF THE DECISTION

Organic Act on State Audit B.E. 2561 (2018) section 98, paragraph one, provides that the administrative penalties are as follows: (1) probation (2) public condemnation (3) administrative fine and section 98, the last paragraph, provides that in considering administrative penalties, the State Audit Commission shall take into account the severity of the behavior constituting the offense and the damage resulting from such actions. The methods for enforcing penalties according to the decision are stipulated in the Regulations of the State Audit Commission on the Consideration and Adjudication of State Fiscal and Financial Disciplinary Offenses B.E. 2562 (2019).

1. A probation penalty , as stipulated in Section 47 of the Regulations of the State Audit Commission on the Consideration and Determination of State Fiscal and Financial Disciplinary Offenses B.E. 2562 (2019), states that: "For imposing a probation penalty, the State Audit Office shall promptly notify the punished person of the decision to impose such penalty." This penalty is of the same type as the disciplinary penalties prescribed in the Civil Service Act B.E. 2551 (2008).

2. A public condemnation penalty , as stipulated in Section 48 of the Regulations of the State Audit Commission on the Consideration and Determination of State Fiscal and Financial Disciplinary Offenses B.E. 2562 (2019), states that "For imposing a public condemnation penalty, the State Audit Office shall notify the punished person of the decision and publish the decision on the SAO’s information technology system for the period specified by the State Audit Commission in its decision."

3. An administrative fine penalty , as stipulated in Section 49, paragraph one, of the Regulations of the State Audit Commission on the Consideration and Determination of State Fiscal and Financial Disciplinary Offenses B.E. 2562 (2019), states that "For imposing an administrative fine penalty, the State Audit Office shall notify the punished person of the decision, and the punished person shall pay the fine to the State Audit Office in accordance with the decision." Paragraph two further stipulates that "Should the fine not be paid correctly and in full by the due date, the State Audit Office shall issue a written warning to the punished person to pay the fine within a specified period, which shall not be less than seven working days. If the warning is not complied with, the State Audit Commission may apply the law on administrative procedure mutatis mutandis." The nature of enforcing such a decision directly impacts the assets of the punished person. To prevent the fine amount from being excessively high, the framework for imposing administrative fines is prescribed in Section 98, paragraph two, of the Organic Act on State Audit B.E. 2561 (2018), stating that "In imposing an administrative fine, the fine shall not exceed twelve months' salary of the punished person." All administrative fines received by the State Audit Office shall be remitted as state revenue, and the State Audit Commission shall be informed of each remittance, as stipulated in Section 49, the last paragraph, of the Regulations of the State Audit Commission on the Consideration and Determination of State Fiscal and Financial Disciplinary Offenses B.E. 2562 (2019).

Home