Financial and Fiscal Discipline

work according to Constitution (B.E. 2560 (2017))

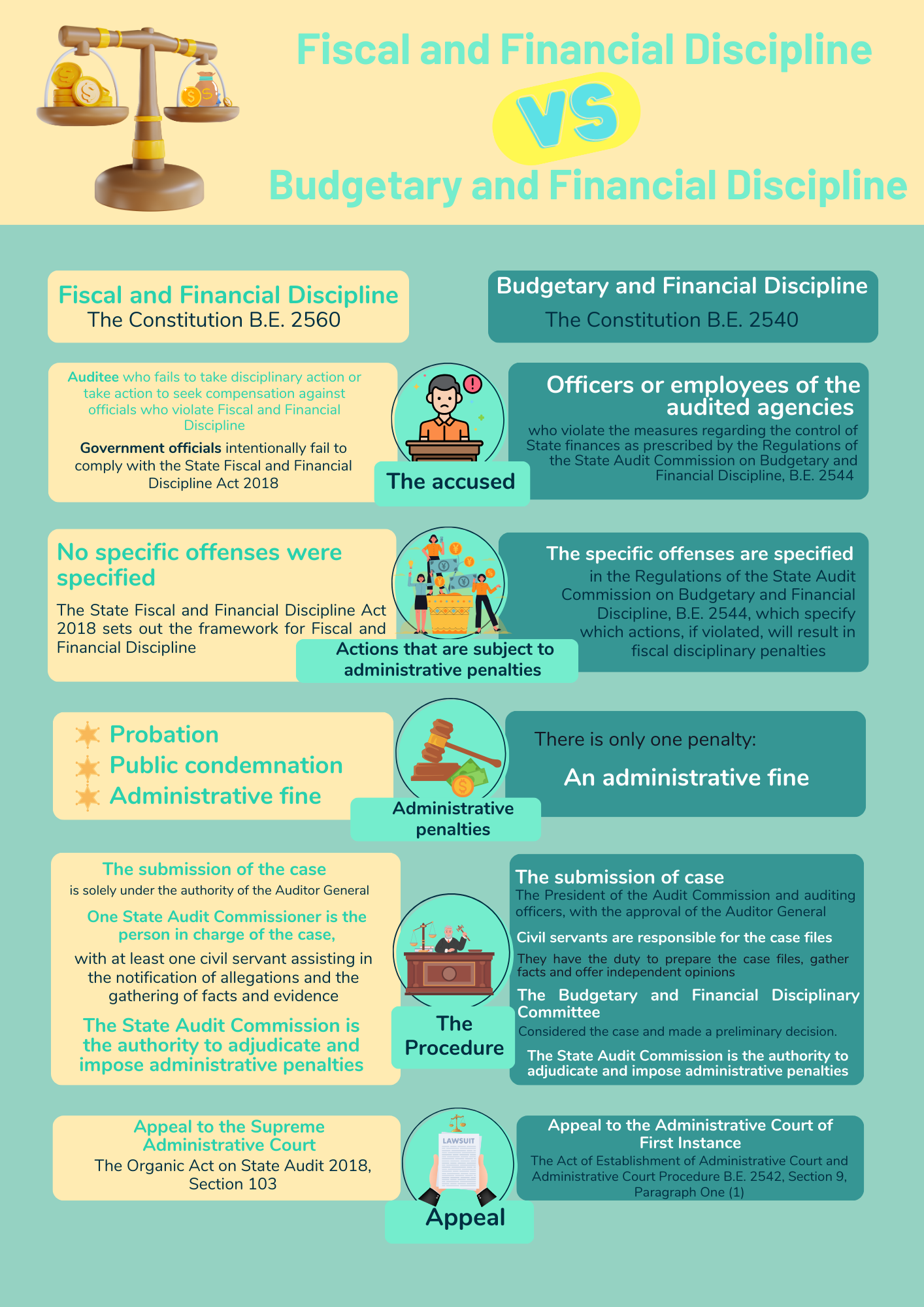

When the Constitution of the Kingdom of Thailand B.E. 2560 was promulgated, the control and inspection of Budgetary and Financial Discipline was renamed to “State Fiscal and Financial Discipline”. The key principle stated in Section 62 stipulates that the state must strictly maintain fiscal and financial discipline in order to maintain the stability and sustainability of the state’s financial and fiscal status in accordance with The State Fiscal and Financial Discipline Act B.E. 2561 (2018). The State Fiscal and Financial Discipline Act B.E. 2561 (2018) was enacted as the framework for maintaining fiscal and financial discipline in accordance with the said section. The authority of the State Audit Commission for administrative punishment in cases of violations of The State Fiscal and Financial Discipline Act B.E. 2561 (2018) is under the jurisdiction of Section 240 of the Constitution of the Kingdom of Thailand B.E. 2560 (2017) in conjunction with Section 80 of the State Fiscal and Financial Discipline Act B.E. 2561 (2018). The current State Fiscal and Financial Discipline under the Constitution of the Kingdom of Thailand B.E. 2560 (2017) in conjunction with the Organic Act on State Audit B.E. 2561 (2018) has different principles from the budgetary and financial discipline under the Constitution of the Kingdom of Thailand B.E. 2540 (1997) and fiscal and financial discipline according to the Constitution of the Kingdom of Thailand B.E. 2550, the following applies:

The accused: Maintaining fiscal discipline is the responsibility of the auditee, which is the head of the government agency or unit responsible for the performance of duties or administration of the audited agencies. If a government official violates fiscal discipline as prescribed by The State Fiscal and Financial Discipline Act B.E. 2561 (2018), resulting in damages, the auditee must take disciplinary action or seek compensation for damages to the state or the audited agencies, as notified by the Auditor General of the audit results. If the auditee fails to comply with the Auditor General's notification, administrative punishment will be proposed by the State Audit Commission for the auditee and government officials who intentionally fail to comply with the law on fiscal and financial discipline. This is in accordance with Sections 95, 96, and 97 of the Organic Act on State Audit, B.E. 2561 (2018), which differs from budgetary and financial discipline under the previous Constitution, where the focus is on punishing officials or employees of the audited agencies who violate the measures regarding the control of state finances as specified in the Regulations of the State Audit Commission on Budgetary and Financial Discipline, B.E. 2544 (2001).

What actions are subject to administrative penalties? The State Fiscal and Financial Discipline Act B.E. 2561 (2018) provides that the State Audit Commission has the authority and duty to impose administrative penalties in cases of violations of the State fiscal and financial discipline. The Organic Act on State Audit B.E. 2561 (2018) does not specify specific offenses. Therefore, the consideration of whether an action constitutes a violation of the State fiscal and financial discipline must be based on The State Fiscal and Financial Discipline Act B.E. 2561 (2018), which establishes the framework for financial and fiscal discipline. However, any action that violates the fiscal discipline framework must meet the criteria for administrative punishment under Sections 95, 96, and 97 of the Organic Act on State Audit B.E.2561 (2018). This differs from the budgetary and financial discipline under the previous Constitution, which clearly stipulated in the Regulations of the State Audit Commission on Budgetary and Financial Discipline, B.E. 2544 (2001), which stipulate which actions violate the framework will be subject to budgetary and financial discipline.

Administrative Penalties: Financial and fiscal discipline clearly stipulates administrative penalties for those who violate the state fiscal and financial discipline under Section 98 of the Organic Act on the State Audit B.E. 2561 (2018). These include probation, public condemnation, and administrative fine. Administrative fine shall not exceed 12 months' salary for the punished person. Administrative penalties shall be considered based on the seriousness of the misconduct and the damage caused by the action. Unlike the budgetary and financial discipline under the previous Constitution, which stipulated only administrative fines and the level of punishment was determined according to the salary at the time of the offense. Level 1 punishment was a fine not exceeding 1 month's salary, and Level 4 punishment, which was the highest level, was a fine equal to 9 to 12 months' salary. Consideration of administrative punishment must take into account the level of responsibility of the accused's position, the importance of the measures to control state finances that were violated, the damage caused to the government, and the intention of the accused.

Procedures: The submission of budgetary and financial discipline cases under the Constitution of the Kingdom of Thailand B.E. 2560 (2017) to the administrative penalty consideration process are solely under the authority of the Auditor General, in accordance with Sections 96 and 97 of the Organic Act on State Audit B.E. 2561 (2018). The State Audit Commission has the authority to adjudicate and impose administrative punishment, with one State Audit Commission member acting as the committee member in charge of the case and at least one official from the Office of the State Audit acting as an assistant. The notification of charges to the accused, the submission of a statement of defense by the accused, the gathering of facts and evidence, and the consideration and adjudication of administrative punishment shall be in accordance with the criteria and methods prescribed by the Regulations of the State Audit Commission on the Consideration and Adjudication of State Fiscal and Financial Disciplinary Offenses B.E. 2562 (2019). This differs from the proposal of budget and financial discipline issues under the previous Constitution, which stipulated that the President of the State Audit Commission and the audit officers, with the approval of the Auditor General, have the right to propose issues, and an official from the State Audit Office is responsible for the case file. One person is responsible for the case file, collecting facts, and independently providing opinions to the Budgetary and Financial Disciplinary Committee. Once the Budgetary and Financial Disciplinary Committee has considered and reached a decision on a case, submit the decision on that case to the State Audit Commission for further consideration.

Appeals against decisions of the State Audit Commission: Section 103 of the Organic Act on State Audit B.E.2561 (2018) stipulates that those subject to administrative penalties may appeal to the Supreme Administrative Court within 90 days from the date of receipt of the decision. If a punished person demands to challenge the State Audit Commission's decision, the jurisdiction of the Supreme Administrative Court rests with the Supreme Administrative Court. This differs from the budgetary and financial discipline under the previous Constitution, which did not specifically stipulate appeals. Appeals against decisions of the State Audit Commission, which have the legal status of an administrative order, must therefore be governed by the Administrative Procedure Act B.E.2539 (1996). Appeal with the Administrative Court is governed by the Act on Establishment of Administrative Courts and Administrative Court Procedure B.E.2542 (1999), Section 9, Paragraph One (1), and falls under the jurisdiction of the Administrative Court of First Instance.

Despite these differences, state fiscal and financial discipline under the current Constitution retains the legal status of an administrative order, with the enforcement of the offense as an administrative enforcement. Including the determination of administrative punishment does not deprive the authority of the supervisor of the punished person by discipline to consider disciplinary punishment for the same reason again, but such punishment must be a punishment other than a salary deduction or salary reduction, similar to the budgetary and financial discipline under the previous Constitution.

Home